This week we wrap up our examination of the three equal-weighted metrics that comprise the State Fiscal Responsibility scoring in the recent NMA report, “Motorists Beware: Ranking the States That Treat You Worst.” Part 1 (Legislative Interference with Transportation Planning, #289) rated the influence of lawmakers in determining the planning and spending of funds on state transportation projects. That was followed by a review how much of state-collected fees and taxes are applied to true—roads and bridges—highway projects (How Well the States Apply Your Road-User Fees, #290). Now we add the critical third leg which will determine whether each state’s fiscal responsibility platform stands firm or wobbles under the weight of the political process.

The diversion of federal-tax revenues from road aid to transit capital projects is galling. This op-ed from the Washington Examiner reflects our feelings well, particularly in light of the continued deterioration of the nation’s highway infrastructure. An analytical approach was necessary to properly evaluate how each state utilizes the resources it receives from the federal Highway Trust Fund. Our source of information was the November 2012 report, “GAO-13-19R Flexible Funding,” a tabulation of the amount of federal apportioned road aid transferred (“flexed”) to the Federal Transit Administration (FTA) for transit projects, by state, in the years 2007 to 2011.

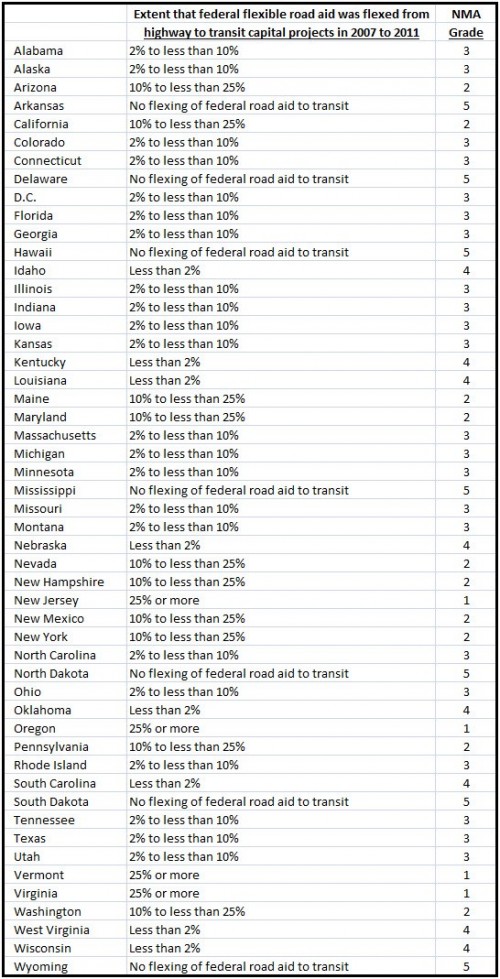

We used the following rating guide for each state, with 5 points being the most favorable score:

- 5 points: No flexing of federal road aid to transit between 2007 and 2011

- 4 points: Less than 2 percent of aid flexed

- 3 points: 2 percent to less than 10 percent of aid flexed

- 2 points: 10 percent to less than 25 percent of aid flexed

- 1 point: 25 percent or more of federal road aid flexed to transit projects from2007 to 2011

Road-user fees collected by the federal government are returned to the states in the form of annual apportionments for each of about six major federal-aid highway programs. The aid under many of these programs can be transferred from highway projects overseen by the Federal Highway Administration (FHWA) to transit capital projects overseen by the FTA. The decision to transfer, or flex, road aid is up to each state. The percentage flexed can vary greatly from year to year so our rating makes use of a five-year tabulation made by the General Accounting Office to indicate how prone each state was to divert motorists’ fees to transit capital projects. These latter projects range from highly-inefficient low-speed trolley lines to mass-transit and bus services.

Observations made upon review of the GAO data:

- Seven largely rural states flexed no highway aid during the 2007 to 2011 period (Arkansas, Delaware, Hawaii, Mississippi, North Dakota, South Dakota, and Wyoming).

- Four states flexed more than 25 percent of their federal highway aid during the period (New Jersey, Oregon, Virginia, and Vermont). Three of these states are building rail-transit projects with extremely low benefit-to-cost ratios (Bergen, NJ light rail; Portland, OR streetcars; Dulles, VA silver WMATA line).

Without further adieu, the scoring by state: