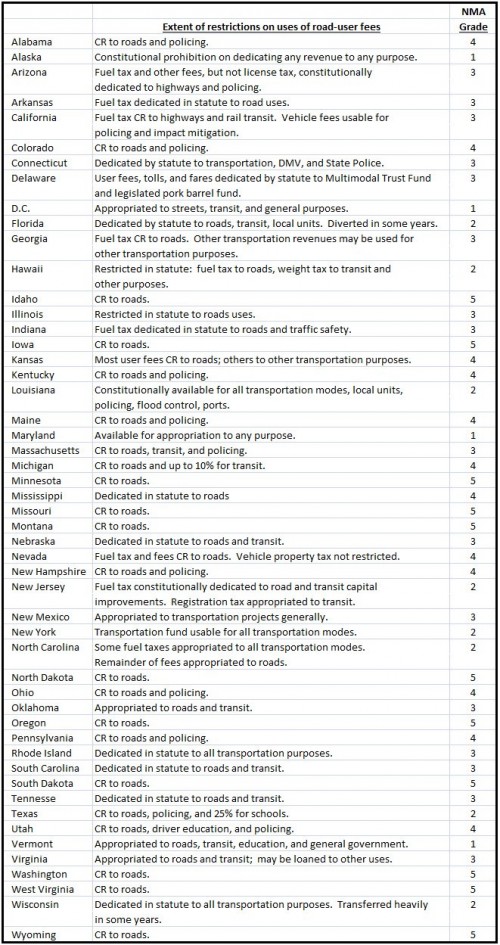

- 5 points: Road-user fees are constitutionally restricted exclusively to road construction and maintenance.

- 4 points: Road-user fees are constitutionally restricted to road use, plus transit or policing.

- 3 points: Road-user fees are divided by statute among roads, transit, policing, and other road-related uses.

- 2 points: Road-user fees are heavily diverted to transit and non-transportation uses.

- 1 point: Road-user fees are appropriated at will for any purpose.

The basis for our evaluation was again answers supplied by state DOT officials to mid-2010 survey questions posed by AASHTO (American Association of State Highway and Transportation Officials) and by NCSL (National Conference of State Legislatures). The answers were supplemented from other sources. It should be noted that not all states obey their statutes, or even constitutional restrictions for all user fees.

Road use for these purposes is defined as road and bridge overhead, planning, engineering, construction, operation, and maintenance without regard to state vs. local jurisdiction. We have excluded transit as well as highway patrol or other policing. Road-user fees are comprised of fuel taxes, registration taxes and personal property taxes on vehicles (although some states responding to the AASHTO/NCSL survey may not regard vehicle property tax as a user fee).

Before presenting the score of each state, here are a few observations:

- Vehicle registration taxes and the gasoline tax were divisive issues in the 1910s and 1920s respectively. When states settled on the fuel tax as the primary source of road funding in the mid-1920s, the agreement seems to have been based on constitutional guarantees that vehicle-related fees would be used only for roads. Twenty-eight states currently seem to have constitutional restrictions on the use of motorist fees.

- Ahh, but the restriction is seldom absolute. State highway patrols are frequently funded from road-user fees, as is license-plate administration by the various departments of motor vehicles.

- Beginning in the 1970s, many states weakened their constitutional protection of road-user fees by extending the use of “transportation” funds to public transit projects.

- Most states that don’t have constitutional restrictions dedicate road-user fees to roads and transit by statute, but these laws can be (and frequently are) amended to shift funds to general purposes either in times of crisis, or as a matter of routine.

Now that we have you sufficiently riled up, here is the NMA scoring by state. Note that “constitutionally restricted” has been abbreviated as CR throughout the table: